Annually, CGI leaders around the world meet face-to-face with business and IT executives to gather their perspectives on the trends affecting their enterprises, including business and IT priorities, budgets and investment plans. In 2019, we conducted in-person interviews with 62 client executives in the corporate and transaction banking sector who cite evolving customer needs, as well as regulation, security, technology advances, and real-time payments and platforms, as dominant drivers this year.

“Regulation and security” remains the most impactful industry trend

| “Mounting and evolving regulation and security standards” remains the most impactful industry trend this year. “Industry standards, real-time payments and payment regulations” becomes the second most impactful trend, while “technology advances and adoption” comes in third. |

| “Real-time, low-cost and resilient operation platforms” follows in fourth, with driving down costs to adapt to new banking economies placing fifth. |

|

Increasing regulation and security challenges were the top cited trend in 2018, followed by technology advances and the adoption of new technology. |

| Standardization and the move to around-the-clock, real-time payments was the third top trend, followed by a highly competitive market, and cost reduction to adapt to new banking economics. |

![]()

Key findings

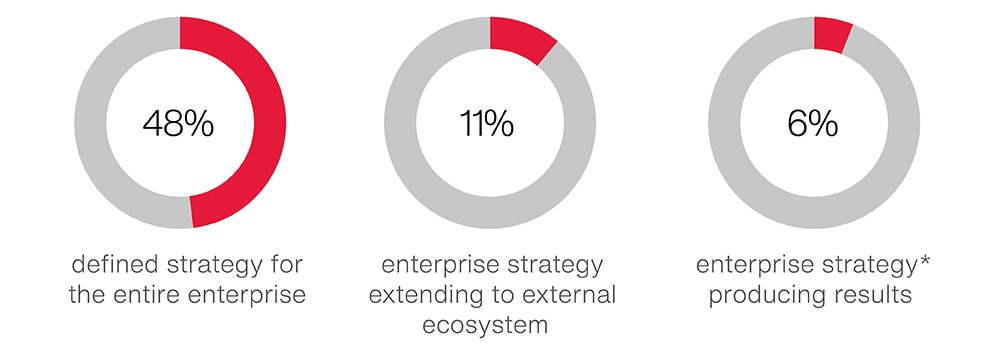

Only 6% producing results from enterprise digital strategies

Eighty-nine percent of corporate and transaction banking executives indicate they have a digital strategy in place, with 48% having a strategy for the entire enterprise. However, only 6% indicate their organizations are producing results with their enterprise digital strategies.

Explore how organizations are gaining value from their enterprise digital transformation strategy.

Regulatory compliance and cybersecurity are top challenges

Corporate and transaction banking executives cite regulation and cybersecurity as their top two challenges in pursuing digital transformation.

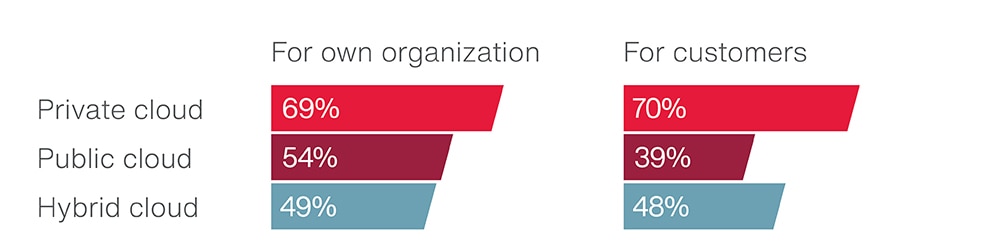

79% are using the cloud

This year, executives shared how they are using cloud-based solutions to store and/or process data. Thirty-six percent said they are using it for their own organization, 38% for customers, and 5% for both. Additionally, they indicated how their organization’s cloud usage is divided between private, public and hybrid clouds (as shown in the above chart). When asked if their organizations have mechanisms in place to locate where key data assets are stored in the cloud, nearly one in five executives do not have clarity on this issue.

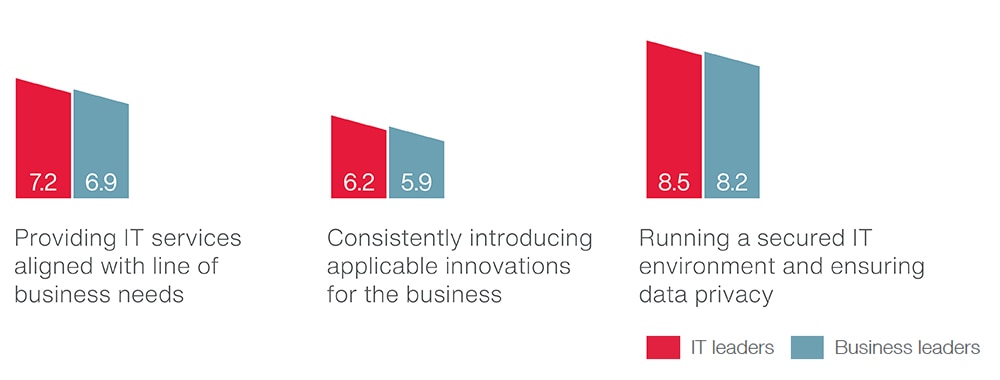

Benchmarking clients’ satisfaction with their own IT organization

For the second year, business and IT executives interviewed ranked their satisfaction with their own IT organizations based on the 10 key attributes of a world-class IT organization. Overall, IT satisfaction among corporate and transaction banking executives is higher in comparison to other industries and banking sectors.

CGI can provide clients with a discussion of all available benchmarking, including each client’s positioning, on topics such as digital maturity, IT spending, IT satisfaction, innovation investments and more. Contact us to learn more.

Learn how CGI helps clients on their journey to world-class IT.

|

|