Annually, CGI leaders around the world meet face-to-face with business and IT executives to gather their perspectives on the trends affecting their enterprises, including business and IT priorities, IT spending, budgets and investment plans. In 2020, we conducted in-person interviews with 54 client executives on the buy- and sell-sides of capital markets, who indicate a continued focus on protecting client information through cybersecurity.

Interviews were conducted before and after the pandemic declaration by the World Health Organization (WHO) on March 11, 2020, providing unique insights into evolving priorities. We provide a short summary of some of these insights here.

Cybersecurity still dominates as a top trend

| Protecting client data through cybersecurity remains the most impactful trend in 2020. As in 2019, the growing use of advanced analytics, automation and new technology continues as the second most impactful trend. However, executives now view increasing expectations for digital experience services as having greater impact than innovation in digital business models to meet client expectations. |

2020 top trends by impact

|

Post-pandemic declaration trends show rise in use of advanced analytics, automation and new technologies

When comparing interviews before and after the pandemic declaration by WHO on March 11, 2020, digital business model innovation lessens in impact as a trend on the buy-side (-11%), while increasing client expectations for digital experience services lessens in impact on the sell-side (-23%). The use of advanced analytics, automation and new technologies increases for both sides (+10%) post-declaration.

Results from digital strategies are still low

On the sell-side, 96% of executives say their organizations have a defined digital strategy, with 11% producing results. On the buy-side, 84% have a defined digital strategy, with 18% producing results.

Predictive analytics is the top digital transformation initiative

This year, 87% of capital market executives cite predictive analytics as their top digital transformation initiative, followed by digital self-service advisory and execution, and an increase in straight-through processing through automation and robotics.

Interest in substantial managed services dramatically rises after pandemic declaration

We asked capital market executives to share why they use managed services and how they plan to leverage them. The top reasons cited include cost savings, revenue potential and market demands. Responses concerning plans for using managed services vary before and after the pandemic declaration, as in the example shown.

% planning to leverage substantial managed applications in 3 years Buy-side: Sell-side: 67% 2020 post declaration 60% 2020 post declaration 40% 2020 prior to declaration 30% 2020 prior to declaration

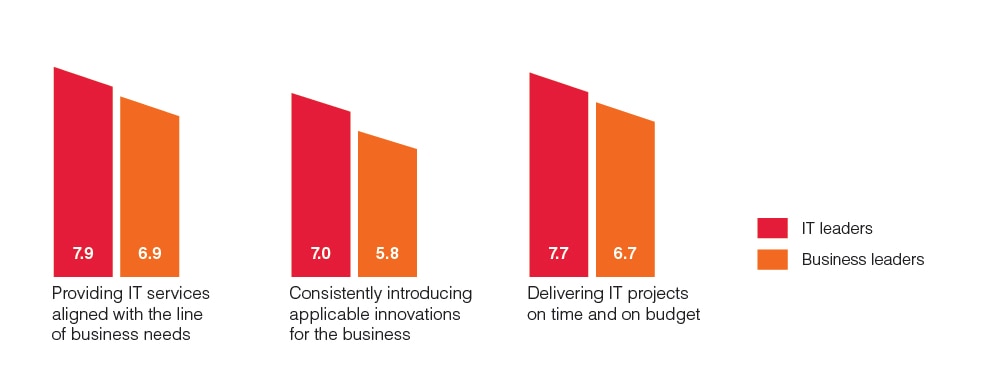

Benchmarking clients’ satisfaction with their own IT organization

(Scores from 1 to 10, with 10 most satisfied, showing 3 out of 10 available attributes)

For the third year, business and IT executives interviewed ranked their satisfaction with their own IT organizations based on the 10 key attributes of a world-class IT organization. For most attributes, business leaders report lower satisfaction levels with their internal IT compared to IT leaders. Consistently introducing innovation has the lowest score at 5.8, which is down a further 0.5 pts compared to 2019.

Learn more about the 2020 CGI Client Global Insights.

Learn more about CGI in Capital Markets.

Speak with a CGI expert

To consult with one of our industry experts to learn more about client insights and CGI’s perspectives on business and technology trends, contact us.