Chief financial officers and chief information officers play pivotal roles in shaping financial discipline and IT modernization within federal agencies. Fraud, waste and abuse threaten budget integrity, operational efficiency and public trust, making it essential for both financial and technology leaders to act decisively before fraud occurs.

For CFOs, the path forward involves identifying and preventing wasteful spending before it occurs through tighter controls and intelligent automation. For CIOs, the challenge is modernizing smarter — not bigger — by transforming legacy systems into agile, fraud-aware platforms.

This guide outlines five key initiatives tailored to CFOs and CIOs to strengthen fraud prevention, align investments with measurable outcomes and protect taxpayer dollars.

1. CFOs: Strengthen financial discipline with AI-driven oversight

Identifying fraud before it occurs requires intelligent automation and advanced analytics. CGI Federal’s solutions equip CFOs with tools to surface financial risks early and enforce tighter controls across procurement, grants and expenditures. By leveraging predictive analytics, agencies can flag irregular spending patterns and prevent wasteful transactions before funds are disbursed — and even before they’re obligated.

2. CIOs: Transform legacy systems into agile, fraud-aware platforms

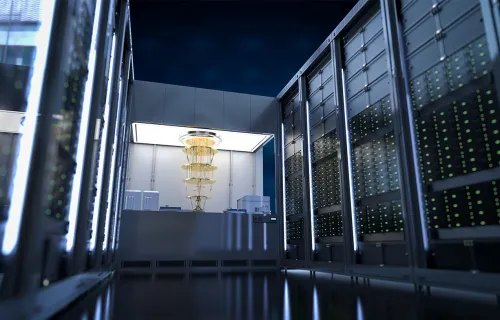

The key to modernization isn’t expanding IT infrastructure — it’s making it smarter. CGI Federal helps CIOs replace outdated, siloed systems with fraud-aware, cloud-based solutions that improve visibility and performance. AI-driven compliance tools strengthen fraud detection, while zero-trust security frameworks safeguard sensitive agency data. Transforming legacy technology into integrated, transparent IT platforms enables agencies to reduce fraud risks and optimize efficiency.

3. CFOs: Reduce procurement fraud and enforce ethical spending

Procurement fraud is a leading source of financial waste. CFOs must establish rigorous vendor vetting processes to ensure contract integrity and transparency. CGI Federal offers blockchain-powered procurement oversight, enhancing contract traceability, identifying potentially inaccurate invoices and duplicate payments, and preventing fraudulent bidding practices. Strengthening fraud prevention task forces within agencies fosters cross-functional accountability, while automated risk assessments ensure that spending remains aligned with mission priorities.

4. CIOs: Align IT investments with fraud prevention and transparency

Technology investments should not only modernize operations but also reduce fraud exposure and enhance transparency. CGI Federal helps CIOs integrate real-time monitoring tools that detect anomalies in digital transactions, contract management and financial systems. By adopting cloud-based fraud prevention platforms, agencies gain better visibility into spending and reduce inefficiencies. Investing in data-driven oversight ensures IT delivers measurable outcomes rather than simply expanding infrastructure.

5. CFOs & CIOs: Drive efficiency through more innovative collaboration

To combat fraud effectively, CFOs and CIOs must work together to align financial discipline with modern technology solutions. Establishing joint fraud prevention initiatives between finance and IT leadership creates a cohesive defense against wasteful spending and cybersecurity risks. Standardized fraud risk frameworks, automated reporting dashboards and collaborative oversight models ensure agencies stay ahead of emerging threats rather than reacting after fraud occurs.

A new approach: CGI’s Fraud, Waste and Abuse Prevention Platform

To help agencies proactively prevent fraud, CGI Federal offers an innovative Fraud, Waste and Abuse Prevention Platform. This solution integrates real-time risk assessment, AI-driven analytics and financial system automation to detect fraudulent activities early, enforce tighter spending controls and modernize IT oversight efficiently.

Ultimately, CFOs and CIOs have the power to lead their agencies into a future of financial discipline, transparency and fraud-resistant modernization. By focusing on intelligent automation, ethical procurement, and fraud-aware technology investments, agencies can prevent waste before it happens, rather than reacting after damage is done.

CGI Federal equips agencies with the tools to enforce stricter financial oversight, modernize IT with transparency, and drive measurable performance improvements, ensuring taxpayer dollars are protected and agencies operate at peak efficiency.