We don’t really think about assets in the form of infrastructure. Even as we drive on roads, drink clean water from treatment plants and flush waste into the sewers, we take them as familiar givens of life in our world. However, someone, somewhere, is responsible for keeping track of those things on behalf of the organizations that own them.

Can government organizations afford to do asset management? They can’t afford not to, according to participants at The Institute of Asset Management (IAM) North America Conference, which took place last October. The consensus among attendees was clear: asset management is essential to providing effective government, strengthening communities and ensuring quality of life for millions.

The term “asset management” reflects different meanings for different stakeholders in an organization. The ISO 55000 Asset Management standard defines an asset as an “item, thing or entity that has potential or actual value to an organization,” and asset management as “the coordinated activity of an organization to realize value from assets.”

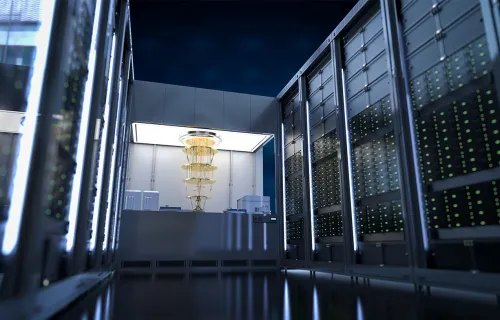

Assets include objects that move from place to place during manufacture, shipment and use—computer chips, military weapons systems or delivery trucks, for example. They also include elements of infrastructure.

Good management demands forethought

Planning infrastructure asset management requires a long-range outlook. Infrastructure elements have useful lives than can span decades, although they require ongoing maintenance and repair throughout those lifespans.

Establishing comprehensive records of the existence, location, condition, repair and replacement costs of all assets is critical. Once this information is captured, an assessment can be created to evaluate the intersection of the condition, criticality, likelihood of failure and repair vs. replacement cost of assets.

The data can then be used to drive asset investment decisions. For example, rehabilitating 50 year old sewer lines in a rapidly growing part of a city should be prioritized over upgrading play structures in neighborhoods with relatively few young children. While both assets may be in need of repair, the consequences and cost of failing to invest in maintaining the sewer lines far outweigh upgrading the play structure. These insights are imperative for strategic decision-making and forecasting where to allocate dollars, and in some cases, where to divert dollars.

Account for changing conditions

Managing assets over multiple decades requires accounting for long-range changes in conditions. Climate change, economic factors and geopolitical events all have potential impact on managing infrastructure, but are only partially predictable.

These impacts, however, create additional demands for investment in the resiliency of assets. Climate change will, over time, cause sea levels to rise, force changes in the geography of food production and affect the supply and demand of energy. Accounting for those dynamics can ensure the long-range plan remains effective.

Plan with society in mind

While budget and financial considerations are important, there are other factors that also need to be considered in infrastructure asset management planning. Asset investments are one way to address social injustices by providing citizens in historically underserved areas with access to improved infrastructure and public services such as hospitals and recreational facilities. While not traditionally a core component in conversations about community objectives, assets and the holistic examination of them in the context of community can foster new perspectives as well as real world insights into the future state.

Looking into the future

The future of asset management needs to be a part of the public consciousness. Infrastructure, such as bridges and dams, has a lifespan of decades and is a challenge to update. Personal property items like computers and electronic equipment have lifecycles usually ranging from five to 20 years.

Infrastructure asset management, therefore, requires a truly forward-looking perspective. Decisions made today need to still be the right choices as time passes, even a century in some cases. Asset managers should develop their plans with this perspective in mind.

Predicting the future is always a gamble,but plans that address potential future problems help ensure the lasting success of the organization and its mission.

Learn more about Sunflower asset management solutions at CGI Federal.