Each year, we meet face-to-face with business and IT executives around the world to gather their perspectives on the trends affecting their enterprises. In 2019, our CGI Client Global Insights reveal, once again, that utilities are making considerable progress in their digital transformation journey, with 92% of executives now reporting their organization has a defined digital strategy in place.

Additionally, utilities leaders say their IT investments have increased, and they have moved beyond progressing with discrete digital projects, such as mobile applications. They now cite digital maturity progress for customer engagement and intelligent automation. They also report advances in creating omni-channel and digital-only channels, along with greater implementation maturity for simple automation scripts and robotic process automation (RPA).

However, a fundamental question remains: Are utilities producing results from their digital strategies?

Despite the progress observed, only 11% of utilities executives say their organization is producing results from their digital strategy, which is in line with the cross-industry average of 10%, and significantly lower than the more digitally advanced retail-banking sector (20%).

Why is this and what are leading utilities doing differently to achieve better returns on their digital investments?

Going back to the drawing board to get the foundations right

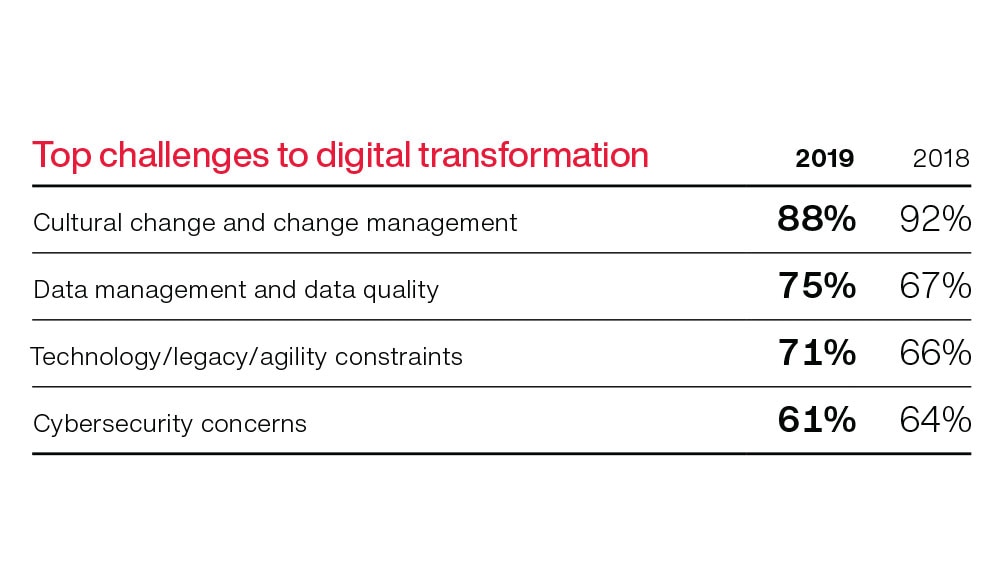

Utilities are taking a more pragmatic look at their digital strategies and reassessing their pace of transformation, revisiting the foundations required to enable true transformation of their business models. They seek greater progress with IT modernization and organizational models to tackle the two key challenges to transformation that have grown in importance in the last five years: cultural change and change management, and legacy IT systems.

Driving IT modernization remains the most important IT priority, as in 2018, as executives continue to grapple with aging, complex and highly customized systems that are expensive to maintain and are not designed for collaboration, flexibility and agility. Only 52% of executives say their organizations have adopted agile methods for selected projects, and just 11% have adopted agile at an advanced level across the enterprise.

Utilities’ modernization efforts also must extend to the IT organizational model to achieve greater efficiency and agility, with IT becoming more customer-centric and embedded within the business. This includes a balanced approach to cloud adoption as an efficient, scalable and reliable infrastructure, not only to optimize the business, but also to lay the foundations for its evolution to support new ways of working and drive innovation.

Recognizing that culture is eating strategy for breakfast

The need for agility and speed to spur innovation and drive transformation has come into sharper focus, with leading utilities rethinking how their organizations innovate, change and operate continuously at scale and pace. With innovation and agility the key drivers of value creation, moving to new business models requires much more than technology. Utilities also must design organizations that can generate ideas and value faster. However, the agility levels reported by utilities executives remains low again in 2019, lagging considerably behind more customer-centric industries such as retail banking, which may provide best practices to emulate. (Find further insight on this topic in this Smart Energy International recorded webinar.)

Leading utilities are moving to simpler, flatter organizations and teams that are closer to the customer and more empowered to act. More than eliminating layers and empowering front-line employees, some are taking inspiration from the Spotify model to create focused, autonomous business units that are free to partner with other business units and create their needed ecosystems. These teams become more agile, informed and customer-centric, and are quicker to respond to a dynamic market.

Jointly empowering IT and business to focus on products, not projects

Executives indicate a growing trend to empower jointly the CIO and line of business to lead transformation efforts, driving an agile way of working and aligning priorities and the pace of change between the two groups. Innovation to address customer needs and personalization requires an iterative, agile and collaborative way of looking at technology and business together through cross-functional teams that develop products and services and continuously infuse customer insights. Involving the business to validate the project implementation of business requirements when IT sees the need is quite different from having IT and business focused on creating great products, together, for massive adoption by customers.

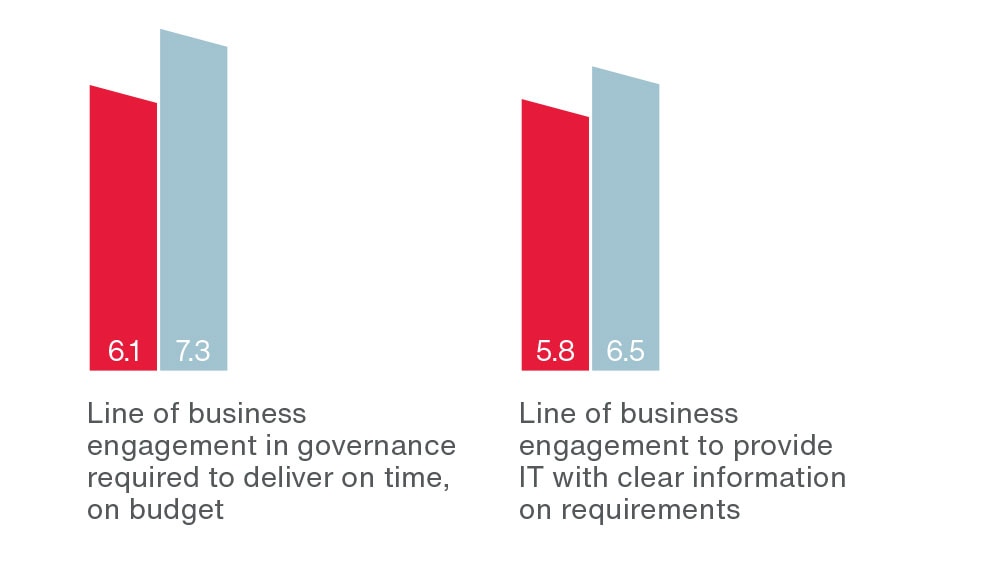

Aligning IT and business is key to improving performance

Utilities report important gaps in business and IT leaders’ satisfaction regarding several attributes CGI has identified for world-class IT organizations. The largest gap is reported when evaluating line of business engagement in the governance required for IT to deliver projects on time and on budget. In our experience, business teams see the benefits of working with IT in agile ways, but IT is under pressure to control the costs of more challenging agile methods. Stronger coaching of business teams on the discipline of agile delivery can mitigate these gaps.

Benchmarking attributes of a world-class IT organization

Business leader satisfaction vs. IT leader satisfaction

Scores from 1 to 10, with 10 most satisfied (showing 2 of 10 available attributes)

As in previous years, we continue to see a correlation among those public companies where IT and business are aligned tightly, and those with the best financial performance. Creating a view of the status of your organization across these world-class attributes can help prioritize what is most impactful to the execution of your digital strategy to create a program for continuous improvement.

Reinforcing data as the new “digital capital”

The need to harness data insights is reflected among utilities executives’ top business and IT priorities, IT spending trends, and top area of innovation investment, now, and even rising in the next three years. However, data does not yet rank as having the highest impact on the business, explained by the fact that half of executives indicate their organizations are in the “explore” and “design” early stages of exploiting analytics. Also, three-fourths say their digital strategies continue to face data quality and data management challenges that have persisted over the last several years.

In our experience, additional data challenges include identifying and prioritizing use cases, proving the ROI for larger programs, orchestrating data across multiple sources, and the inability of users to exploit data. While it is important to have a data strategy and roadmap for a wider program, the strategy should be phased into smaller programs. These programs can be comprised of prioritized use cases deployed in a shorter term that together provide a solid business case, allowing for data to be progressively curated on the job and as needed. This also helps prove the value to the business and releasing funds to finance the next phase.

Improving your digital ROI: The trick is focus and collaboration

Execution also eats strategy for breakfast, so it is essential that departmental digital initiatives are underpinned by an enterprise strategy and are aligned with the business imperatives to avoid disjointed efforts. Utilities leaders differentiate themselves in achieving better returns on their digital investments by focusing on a core set of integrated initiatives designed to scale up, and by driving collaborative, end-to-end models with the early involvement of all stakeholders impacted by the changes.

If you would like to discuss these and other insights, please email me.

For further insight