Welcome to tailor made Wealth Management

Over the past few years, the Wealth Management space managed to be largely immune from the hot wind of change that has been blowing through the rest of Financial Services, however this is coming to an end. The twin trends of changing demographics and ubiquitous digitisation mean that wealth management firms need to start their journey sooner rather than later if they are to maintain their position in the market. A combination of new digital entrants and nimble compaction will significantly increase competition for customer business.

The changing demographic for wealth management firms face is exhibiting itself in the same way it is for the Building Societies in the UK. Their customer base is getting old, both sectors need to attract a new customer base from the tech savvy millennials and Gen Z if they are to persist. Wealth management firms also face a rise in the number of women who are taking over management of funds, a demographic they have underserved in the past.

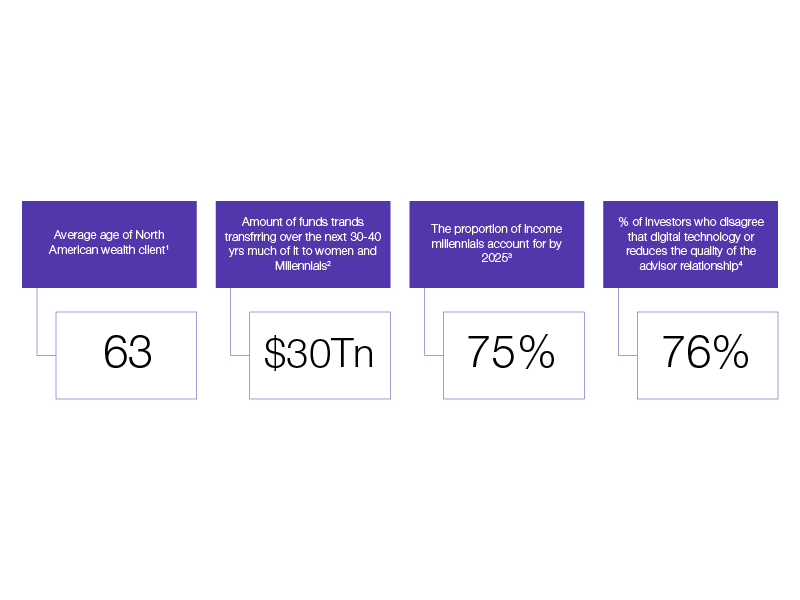

Here are a few numbers to support this:

Figure 1 - changes in customer base

As if that wasn’t enough, the customers who represent the new demographic are also the customers who are most heavily invested in digitisation and those who will expect more from the technology delivered by wealth management firms. That’s before you consider the other challenges that are out there, notably intensified competition and an ever-increasing regulatory burden. Let’s leave those for another blog; today I am focussing on demographic changes and the rise of digitisation.

What do these trends mean for Wealth Management and how can we respond?

The new generation of customers will still look for expertise and advice from Wealth Management firms but will want to consume this in a very different way from today. It is also very obvious that the current “high touch” services delivered to the ultra-high net worth individuals will not scale to an increasing customer base who will be more numerous but will not deliver or be willing to contribute to high margins.

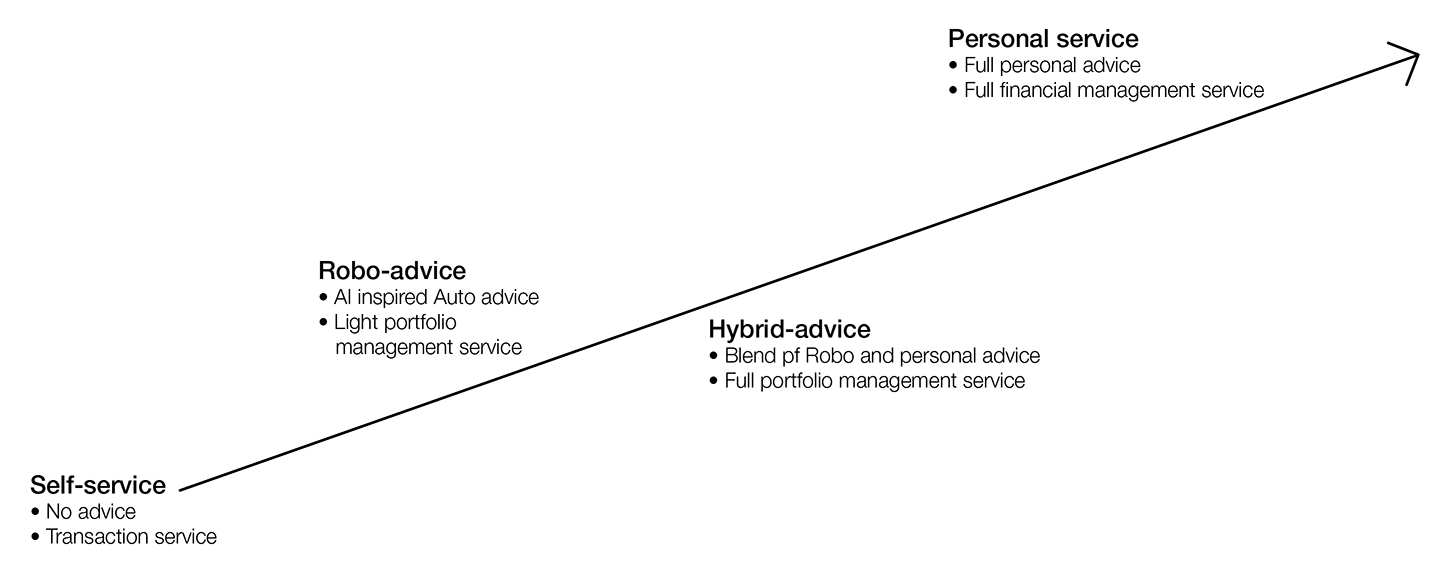

The graphic below demonstrates the type of continuum that would be required to satisfy the broader Wealth Management market realised by the changes we are discussing.

Figure 2 - the service continuum

How can these somewhat conflicting needs be met to provide a seamless customer experience for all types of that, as well as allowing people to take advantage of services across the board? For example, there should be nothing stopping an ultra-high net worth individual indulging in self-service or a less affluent individual having access to personal services.

The key here is, and probably always will be, data and more specifically how that data is used.

With the advent of open banking, capturing financial data about a customer is now a much easier proposition. Other data feeds such as e-receipts mean that a more accurate picture of an individual is available. That data tied to investment performance data and well-crafted AI/ML algorithms mean that accurate investment advice can be generated. Additionally, these algorithms can give insight into individuals’ behaviors with the data itself being useful across the full spectrum of customers. This then gives account managers real insights into current financial activity and predicted performance. Even the ultra-high net worth customers would benefit from these automated insights, whilst enabling wealth management firms to offer services to customers who are not in this rarefied category. Thus, services like hybrid or robo advice and even self-service would be available across the customer base.

The key to providing these insights is to have a clear data strategy; what, how, where aligned to a strategy for deploying AI/ML algorithms as well as a performance data strategy that will provide the best insight to client managers and clients alike regardless of their channel of interaction. This is the way to provide a personalised experience for every customer regardless of where they are on the service continuum. Having such a strategy and building a delivery platform on the back of such a strategy will allow Wealth Management firms to maintain relevance with a new generation of customers but just as importantly, it will allow wealth management firms to control cost income ratios whilst providing these services.

I will be exploring these trends in more detail and attempting to make sense of what technologies, both existing or upcoming that could help address the issues described above in my next blogs.

Leave a comment or get in touch with me directly to discuss this topic further or learn more about CGI in Wealth Management.

References

1Accenture. (2016). Future of Wealth Managemt.

2http://www.bankinvestmentconsultant.com/news/gen-x-gen-y-represent-sweet-spot-for-retirementspecialists. (n.d.).

3Unknown. (n.d.). http://www.cafmerica.org/. Retrieved from generation-g=the-millennials-and-how-they-are-changing-the-art-of-giving.

4Accenture. (n.d.). Accenture-Generation-D-Europe-Investor-Survey.pdf. Retrieved from https://www.accenture.com.