Since the COVID-19 outbreak began in the key global manufacturing hub of Wuhan, China, the impacts on the broader industry have been growing exponentially. They are compounded further by the complexities and interdependencies of a global supply chain.

As many manufacturers continue to slow or shut down operations, decisions are extremely difficult for leaders and their employees alike. However, as with past crises, manufacturers are responding with fortitude and outside-of-the-box thinking, hoping to rebound from the pandemic stronger than before.

In this blog, my colleague Marcel Mourits and I want to explore some of the pressing impacts and share a few approaches that could help manufacturers accelerate their efforts to respond, then rebound when ready and reinvent for the longer term.

China and the global supply chain domino effect

Over the last few decades, China has emerged as critical component of the supply chain. The current pandemic has affected almost all of its industries: from processing raw materials like magnesium, silicones, phosphorus and wood, to producing textiles and processed fibers, to making components for machinery and electronic and high-tech products.

The impacts of COVID-19 on Chinese manufacturing have created a significant domino effect in the global supply chain because of the extensive web of interdependencies. To explore this, let’s look at an example in the automotive industry. A global car manufacturer (original equipment manufacturer or OEM) has approximately 200 tier 1 module or system suppliers, 600 tier 2 component suppliers and more than 3,000 tier 3 parts and materials suppliers. The OEM purchases directly from a few tier 1 suppliers that, in turn, buy from tier 2 suppliers that procure from their tier 3 suppliers. While manufacturers can skip the interchange between tiers and purchase products directly, this further increases complexity and hampers end-to-end supply chain transparency and visibility.

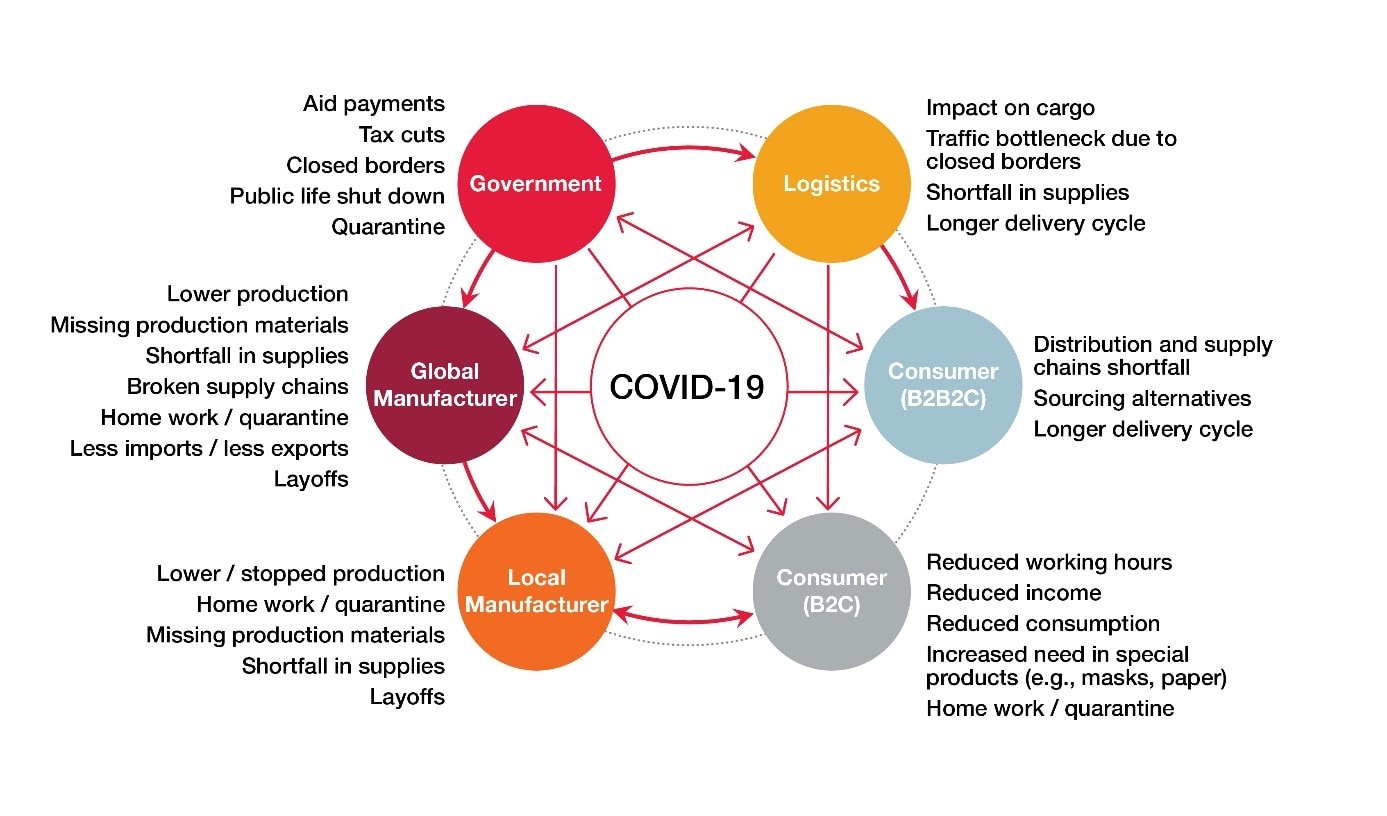

In the illustration below, we look at global supply chains in the context of the market participants to explore further these dependencies and the impacts of the COVID-19 pandemic. The supply chain breach started with worker quarantines in China. Unloaded cargo ships also caused supply shortfalls for global manufacturers. Border closings in other parts of the world created traffic jams and longer delivery cycles, even for local supplies. Manufacturing processes slowed or stopped as a consequence. As the virus spread in other countries, more factory workers were sent home for safety reasons, slowing production. Loss of income for employees in many industries also reduces consumer spending, affecting the demand for goods.

Global Supply Chain Interdependencies and COVID-19 Impacts

Across manufacturing industries, production has slowed or stopped almost completely (as in the case of the automotive industry). Supply chains lack supplies and factories face labor shortages with workers at home for safety reasons. Consumer demand and spending have slowed, and many manufacturers have postponed or paused all non-essential projects. As the pandemic escalates, while we cannot predict fully the business and financial implications, it is clear these are challenging times. With revenues declining, the industry’s focus naturally will return to cost savings.

Proactive measures for response

Over the past years, as part of efforts to digitize and accelerate their pace of change, manufacturers have adopted a number of initiatives to optimize operations and reduce costs. While it is hard to make predictions in these circumstances, companies likely will need an even stronger focus on finding further efficiencies and cost savings to prepare for sustainable growth and recovery.

Stop doing

One proactive measure manufacturers can take to eliminate inefficiency is to “stop doing.” The focus should be to stop doing things that are not based on standards. Sometimes it takes a crisis like this to overcome the hesitation to stop cost-intensive individual developments that can be delivered using standard software, for example. The advantage with standards is they are designed to scale in times of growth.

Another action is to stop doing things manually by using robotic process automation (RPA) technologies and investigating technologies like artificial intelligence to help make automated decisions. “Stop doing” is not just a hygiene exercise. In fact, it enables a strategic opportunity to maintain financial health and support long-term competitiveness.

Same for less

A “same for less” approach also can generate cost benefits. Here, the focus is on serious negotiations with all suppliers to optimize labor costs. The result is lower cost, but not lesser value.

More for less

To make a strategic difference, however, a “more for less” approach deserves consideration. This approach is about managing for efficiency, such as by optimizing IT service delivery. This can be achieved through IT managed services, such as managing applications and/or daily IT operations with a balanced, global delivery approach. The potential benefits are significant operational cost reductions and a KPI-driven continuous improvement process for ongoing identification of areas to reduce business and IT effort for both tactical and long-term savings.

In reality, manufacturers may choose to adopt one or more of these measures in combination. Whatever approaches they choose, the focus should be on transforming for growth.

Readying for rebound

In addition to cost savings, manufacturing CXO’s are looking to get back in control and prepare for rebound and recovery. The learnings from this crisis will help them do this, and bring supply chain optimization back onto the priority list

Revisiting their processes, applications and systems can be a major step forward to identify opportunities for cost reduction, while preparing for better flexibility, agility and collaboration in a manufacturer’s supply chain. I look forward to seeing manufacturers succeed in turning pandemic challenges into new opportunities. Please share your thoughts or reach out to me to continue this discussion.