Annually, CGI leaders around the world meet face-to-face with business and IT executives to gather their perspectives on the trends affecting their enterprises, including business and IT priorities, IT spending, budgets and investment plans. In 2020, we conducted in-person interviews with 159 client executives in the retail, consumer packaged goods, wholesale and consumer services sectors, who indicate a continued focus on improving the customer experience. Interviews were conducted before and after the pandemic declaration by the World Health Organization (WHO) on March 11, 2020, providing unique insights into evolving priorities. We provide a short summary of some of these insights here.

Becoming digital to meet customer expectations still dominates

| Once again this year, becoming a digital enterprise to meet customer expectations remains the most impactful trend. Omni-channel as the new normal continues as the second most impactful trend, followed by optimising operations. However, cybersecurity rises to become the fourth most impactful trend above big data and predictive analytics. |

2020 top trends by impact

|

Post-pandemic declaration trends show a rise in optimising operations

When comparing interviews before and after the pandemic declaration by the WHO on March 11, 2020, becoming digital lessens in impact as a trend (-17%) while optimising operations rises (+8%).

Results from digital strategies are still low

This year, 94% of retail and consumer services executives report they have some form of a digital strategy in place, however, only 15% are producing results from those strategies. This is only 1 percentage point higher than in 2019. Additionally, 43% indicate they have an enterprise-wide strategy, but just 21% report their enterprise strategy extends to their external ecosystem.

Few cite having highly agile business models for digitisation

Only 17% say their business model is highly agile (score of 8 or higher on a scale of 1 to 10 with 10 highest) when it comes to addressing digitisation, up 3 points from 2019.

Interest in substantial IT managed services rises after pandemic declaration

This year we asked retail and consumer services executives to share why they use managed services for applications and how they plan to leverage them. The top reasons are to increase business agility and save costs. Responses concerning plans for using managed services for applications vary before and after the pandemic declaration, as in the example shown.

% planning to leverage substantial managed applications in 3 years : 42% 2020 post declaration 35% 2020 prior to declaration 34% 2019

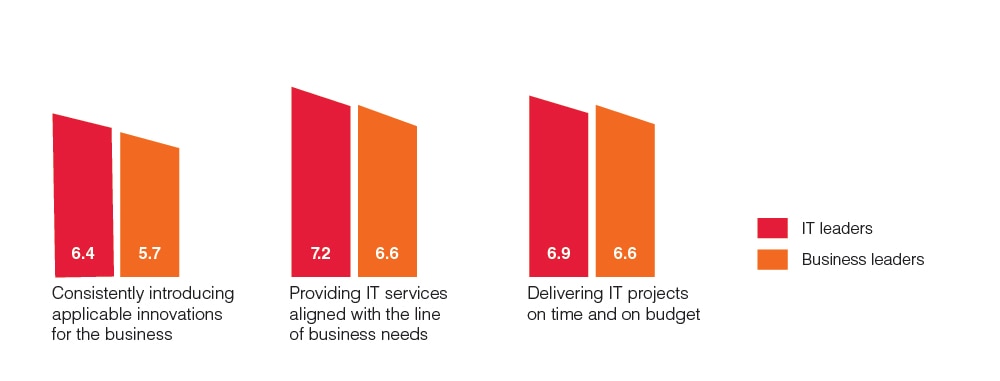

Benchmarking clients' satisfaction with their own IT organisation

(Scores from 1 to 10, with 10 most satisfied, showing 3 out of 10 available attributes)

For the third year, business and IT executives interviewed ranked their satisfaction with their own IT organisations based on the 10 key attributes of a world-class IT organisation. For most attributes, business leaders report lower satisfaction levels with their internal IT compared to IT leaders. Consistently introducing innovation has the lowest average score at 6.2, but this is up 0.5 points from 2019.

Learn more about the 2020 CGI Client Global Insights.

Learn more about CGI in Retail and Consumer services.

Speak with a CGI expert

To consult with one of our industry experts to learn more about client insights and CGI’s perspectives on business and technology trends, contact us.