Rob

is

the

Senior

Vice

President,

responsible

for

leading

the

Central

Markets

Infrastructure

and

Payments

sector

at

CGI,

where

he

oversees

critical

operations

and

the

delivery

of

prominent

payment

systems.

He

is

an

accomplished

executive

with

over

30

years

of

...

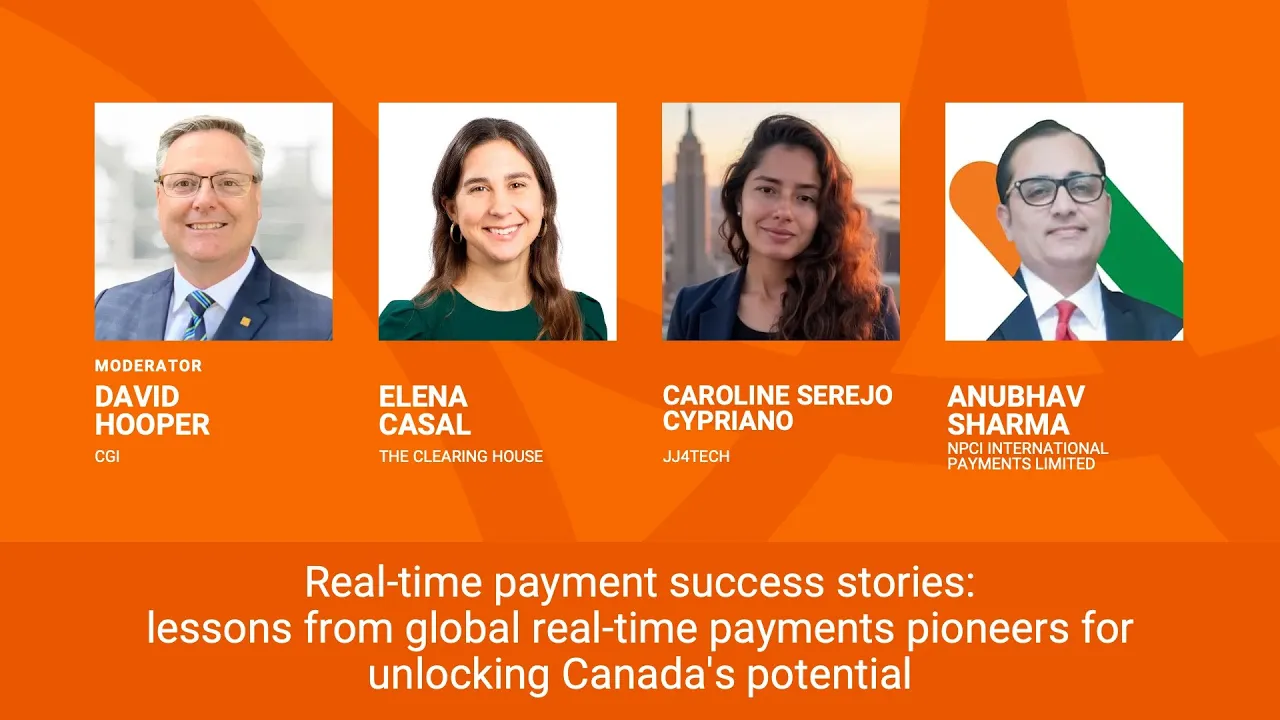

David

Hooper

is

a

banking

and

payments

executive

with

25+

years

of

experience

and

in-depth

knowledge

acquired

within

the

Canadian

and

global

banking

landscape.

David

has

worked

with

financial

institutions

across

North

America

to

support

the

development

of

open

banking

...

Veena

is

a

results-focused

professional

who

brings

energy

and

enthusiasm

to

everything

she

does.

A

particular

strength

lies

in

mentoring

and

inspiring

teams

to

their

full

potential.

Known

as

agile,

resilient,

tenacious

and

adaptive

which

has

helped

her

navigate

...

As

Director

of

Consulting

Services,

Nirbhay

brings

a

wealth

of

experience

in

financial

services

and

specialized

knowledge

of

the

payment’s

domain.

He

possesses

a

deep

understanding

of

the

challenges

and

complexities

associated

with

large-scale

technology

migrations,

consistently

delivering

critical

projects

...