With

over

25

years

of

experience

in

IT

services

across

Canada,

the

U.

S.

,

and

India,

Tarun

Dehariya

is

a

seasoned

business

leader

in

Canada’s

banking,

financial

services,

and

insurance

industries.

As

the

Insurance

Sector

Leader

for

CGI,

he

...

Turning caution into confidence and measurable value

Canada’s insurance industry is entering a defining moment in its digital evolution. The sector is facing unprecedented volatility – driven by geopolitical tensions, shifting tariffs, evolving customer expectations, and the accelerating impact of climate-related catastrophes.

Simply put, modernization is no longer optional in today’s complex reality. Insurers are struggling with an increasingly complex landscape: rising claims, growing fraud sophistication, intensifying regulatory scrutiny, and customers who expect personalized, real-time service.

These pressures are straining traditional operating models, exposing the limits of legacy systems and elevating the need for faster, safer, more-adaptive technology delivery. Across the personal, commercial and life insurance spectrum, the pain points are clear:

- Claims backlogs and long cycle times continue to erode customer satisfaction, especially during catastrophic events.

- Ongoing regulatory changes – from IFRS 17 to evolving privacy and AI governance rules – require constant updates to underwriting platforms, risk engines and reporting systems.

- Increasing fraud complexity as digital channels create new vulnerabilities.

- Product agility has become a competitive differentiator, as consumers demand usage-based insurance, real-time underwriting and personalized coverage bundles.

Real-world examples highlight just how acute these challenges have become. Property insurers facing severe weather events struggle to scale assessment and adjudication. Life insurers managing decades-old policy administration systems find it nearly impossible to update rating tables or introduce new products quickly. Health insurers navigating shifting policy mandates must revise claims rules and provider networks in weeks, not months.

In this environment, insurers can no longer rely on traditional software development cycles that take six, 12 or even 18 months to make changes to products, introduce new products or refresh technologies. AI – particularly generative, predictive and agentic AI – is emerging as a critical enabler across the entire software development lifecycle (SDLC).

CGI’s 2025 Voice of Our Clients research shows that insurers are increasingly viewing Gen AI as critical to future competitiveness. Notably, 46% of insurance executives are already achieving expected outcomes from digital strategies – a marked increase from 38% in 2024.

It’s immensely clear that AI is no longer experimental – it is a business enabler across the SDLC. From requirements and analysis to deployment and maintenance, AI accelerates delivery, enforces compliance and frees teams to innovate.

In this article, we explore the real ROI that insurers are achieving from AI across the SDLC, the impact on key organizational roles, and how insurers can overcome challenges of fear and trust as the technology matures. At the same time, we need to learn from other industries and adapt best practices and innovations in leveraging AI for SDLC acceleration.

Accelerating processes in a bold new era of opportunity

AI is compressing software delivery timelines in regulated industries, but its true value comes when embedded across the full lifecycle – from ideation and requirements to deployment and operations. Development cycles that once took six to 12 months are now being reduced to weeks.

By embedding AI into compliance checks and document review early, insurers reduce risk and free up legal and regulatory teams. Smart automation in test generation, defect detection and code validation boosts productivity. Real-world examples show double-digit reductions in cycle time and operational cost improvement, with higher-quality outputs.

In an industry where advisors remain a primary distribution channel, digitization combined with AI-enabled SDLC acceleration has a direct impact on advisor productivity and satisfaction. By shrinking the time from quote to policy issuance and enabling faster commission payouts, AI-driven development cycles help insurers deliver the seamless, real-time experience that advisors expect. This not only improves advisor engagement, it also strengthens sales momentum by eliminating delays that have historically affected onboarding, underwriting and policy delivery.

Importantly, speed alone isn’t enough. The highest impact comes when insurers pair acceleration with maintainable code, strong governance and human oversight – ensuring that gains in speed don’t come at the cost of risk or technical debt.

Meeting customer expectations through agile SDLC

Today’s connected consumers are demanding personalization, faster responses and seamless digital experiences. For insurers, delivering on those expectations requires more than faster code – it demands heightened agility throughout the SDLC, where every update is reliable, secure and aligned with consumer and regulatory expectations.

AI enables this agility. Trust is reinforced not only through speed, but also through transparency into how AI-driven decisions are made. When done well, agility powered by AI doesn’t simply satisfy customers – it reduces friction, improves regulatory compliance and strengthens consumer confidence in insurance services.

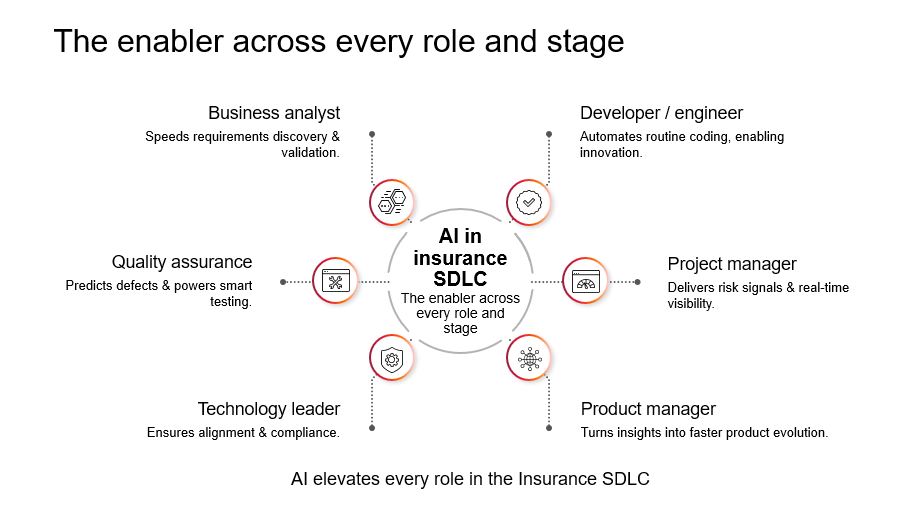

How AI is transforming roles across the SDLC

AI is not replacing people – it is modernizing how work gets done across actuarial, underwriting, claims, IT and digital teams:

- Analysts now validate AI-generated requirements rather than starting from scratch.

- Testers shift from manual execution to automation oversight.

- Developers move from repetitive coding to creative design and integration.

- Product managers use AI-driven insights to align delivery with consumer and business goals.

These changes are already visible in practice as insurers adopt AI to achieve measurable outcomes in productivity, compliance and trust. Yet gaps remain: CGI research shows only 43% of organizations have a holistic AI strategy, underscoring the opportunity for insurers to align AI adoption more broadly across functions and partners.

To realize benefits such as faster release cycles, higher code quality, improved compliance, and a better advisor and customer experience, insurers must begin building AI-ready teams and an AI-first mindset across the SDLC.

AI in action: real-world SDLC applications

A leading global life insurer, serving more than three million customers across Canada, the US and the UK, partnered with CGI to modernize its testing and QA processes using CGI’s NAVI platform. The program delivered measurable improvements across speed, coverage and team effectiveness:

- 45% reduction in test preparation time

- 58 days saved across 11 concurrent projects

- Test coverage improved to 70-85%

- QA teams shifted from repetitive tasks to automation oversight and innovation

NAVI’s impact demonstrates the ROI that’s possible when AI is embedded into the SDLC. Another example is the rapid development of a claim portal, delivered in six weeks rather than the typical four to five months – a critical win for insurers seeking faster time-to-market for digital claims capabilities.

CGI has implemented AIOps at a leading insurer to not only enhance efficiency in managing environments, but also to detect and address potential failures in advance, thereby ensuring enhanced business continuity.

CGI has more than 200 IPs, including some which are being prominently used in North America’s Financial services industry. We have been investing in AI tools to manage, develop, test and enhance these IPs more efficiently and get to market faster.

There are orchestration platforms such as AIOps Director, which have been proven in other regulated industries. With low-code/no-code modeling, built-in compliance controls, and integration of diverse AI models, orchestrators demonstrate how event-driven automation can connect requirements, testing, release and operations. For insurers, these capabilities represent the next wave of SDLC innovation –enabling consistent compliance, faster releases and enterprise-level scalability.

It is still early days. Numerous solutions are available in the market to accelerate the SDLC, but few are showing the maturity and leadership to enable real impact. We will see further evolution and consolidation in this space – especially with the introduction of Agentic AI. We will eventually see a handful of solutions truly gaining acceptance across the industry.

Overcoming fear and building trust

Despite clear successes, challenges remain. CGI research shows that while 84% of insurers have applied AI strategies internally, only 51% have extended those capabilities across partner ecosystems, raising concerns about scalability and preparedness. Employees are often skeptical, with developers and testers worrying about job displacement. At the same time, trust gaps persist, as many still lack a clear understanding of what AI can realistically deliver. Without the right safeguards, governance concerns also surface – particularly the need for policy gates and audit trails to ensure compliance and accountability.

For insurers, the first step toward an AI-enabled SDLC is not technology – it’s mindset. A shift from ‘AI as threat’ to ‘AI as enabler’ is essential. Success requires helping IT, actuarial, underwriting and claims teams see AI as a productivity multiplier – reducing manual work, improving accuracy and elevating professional judgment. That includes creating a top-down AI vision, exposing teams to practical value through real use cases and showing how AI reduces manual effort while elevating their roles. Many teams resist AI simply because they do not yet see how it makes their work easier, faster and more meaningful.

The solution is not to slow down adoption, but to approach it in a structured, trust-first way. Insurers can begin by applying AI to internal processes before scaling outward, giving teams a safe space to build experience and confidence. Human-in-the-loop governance should be embedded from the start, ensuring that underwriting decisions, pricing rules and claims outcomes maintain the level of oversight that regulators and policyholders expect. Just as important, ROI must be measured at each stage to demonstrate tangible value and reinforce trust. With this approach, insurers can move past fear and build confidence in AI as a reliable, compliant enabler across the SDLC.

CGI helps insurers navigate this shift by making sure they have a clear, actionable AI strategy that sets priorities, aligns teams around real business outcomes, and puts the right governance guardrails in place. We also help build operating practices that match each carrier’s risk appetite and regulatory environment to ensure that strategy becomes action. With AIOps, we show how insurers can anticipate system failures before they happen, reduce outages during heavy claims periods, and automate routine operational work so their teams can focus on the problems that actually move the business forward.

With the right mindset, governance framework and real-world examples, insurers can build a culture that embraces AI confidently for a new era – accelerating SDLC modernization and improving outcomes for advisors, policyholders and internal teams alike.

Bottom line: Act now, build for the future

AI is here to stay. For insurers, the opportunity is to transform the SDLC into a faster, safer, more compliant engine of innovation, with the objective of supporting consumers at the time of their need – with more accurate risk ratings, right-sized premiums and faster claim adjudications and settlement. CGI is well positioned to support insurers on this AI-enabled SDLC journey through its investments and innovations.

CGI NAVI and the broader CGI AI portfolio show what is possible today. Orchestration and agentic AI point to the future. The path forward is clear: start small, build trust and scale strategically. Insurers that embrace this journey will accelerate delivery, strengthen compliance and improve consumer outcomes. Those that delay risk being left behind.

Learn more about CGI's NAVI solution and how CGI’s AI services are helping insurers accelerate innovation with confidence.