Guillaume

Bort

is

the

global

leader

for

CGI’s

Mergers

&

Acquisitions

Advisory

business

consulting

service.

Based

in

Canada,

Guillaume

collaborates

with

clients

on

a

wide

range

of

M&A

related

activities,

including

M&A

process

optimization,

stakeholder

management,

pre-investment

due

diligence,

post-investment

...

For many organizations, M&A transactions are key to advancing their business strategies. However, they also are unique and infrequent, resulting in limited experience and processes for addressing the inherent challenges that come with this activity. CGI’s M&A Advisory Services fill the gap, providing comprehensive insights, models, frameworks, and tools to accelerate business growth and value creation through strategic M&As.

Our advisory services help organizations avoid common challenges, including:

- Culture gaps: Mergers depend on compatible cultures. Through our change management approach, including cultural preparedness support, we help you assess culture risks, resolve culture gaps, and achieve culture alignment.

- Undefined integration platform: Some organizations pursue M&As without a predefined integration operations platform. Our M&A approach and platform accelerate integration and minimize disruption through well-defined organizational models, policies, and processes.

- Incomplete or slow integration: The failure to integrate sufficiently or quickly enough can limit the M&A benefits. Our consultants work with you to define and execute a well-defined integration plan that meets critical timelines for the benefit of all stakeholders.

In our experience, the following elements lay the foundation for a successful M&A by reducing uncertainty, aligning stakeholders, and reinforcing accountability.

- Defined organizational model with clear accountability: Aligns culture, governance, and operations, fostering stakeholder alignment, incentivizing collaboration, and enhancing accountability for leaders throughout the M&A project.

- Integration operations platform with clear policies, processes, and metrics: Accelerates integration, mitigates risk, and provides clarity and certainty in critical areas such as customer management, employee management, contract management, and governance.

- Repeatable integration approach covering the entire M&A life cycle (from sourcing through integration): Links merger phases consistently for improved outcomes, avoids reinventing the wheel, prevents common mistakes, and enables deployment of best practices.

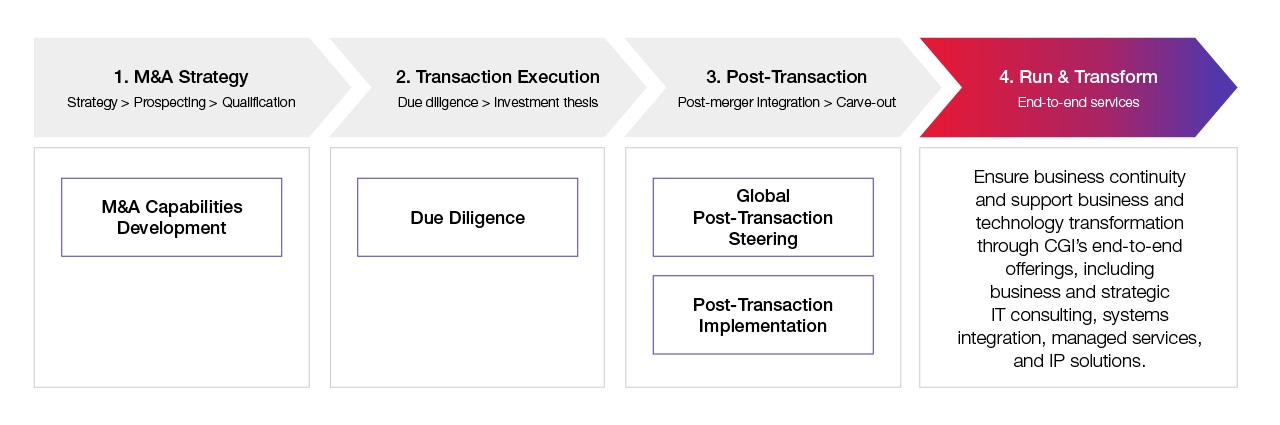

CGI delivers these key elements to clients through a four-pillar approach. This approach covers every phase and tower (e.g., organization, HR, change management, security, etc.) of the M&A life cycle, providing all the necessary resources for completing each phase quickly, efficiently and with the desired outcomes.

M&A four-pillar approach

The advantages of our value-led M&A approach

We bring in-depth experience to every client engagement—from our know-how in acquiring and integrating more than 100 companies, to supporting many M&A client engagements across industries and geographies. This enables us to offer your organization valuable insights, lessons learned, best practices, frameworks, tools, and capabilities.

The advantages we offer include:

- Extensive experience in delivering M&A transactional services, conducting due diligence, and managing post-acquisition integration to maximize value at every stage of the process.

- Tailored M&A Advisory Services guiding precise execution of M&A strategies to achieve transformational growth.

- Comprehensive M&A approach and proven M&A framework encompassing 16 major work streams—including business, organization model alignment, change management, finance, operations, legal, security, IT integration, etc.—and adaptable templates.

Cases in point

Our M&A consultants collaborate with client executives to think boldly and act pragmatically in executing M&A transactions. Here are examples of proven use cases where we have supported our clients’ M&A journeys from end to end.

- Optimization of M&A processes for a leading Canadian bank

-

- Mobilized senior leaders in the areas of risk management, IT, legal, finance, etc. around a common vision and the development of guiding principles for M&A process improvement

- Provided via CGI's M&A Center of Excellence a set of proven tools (framework, templates, etc.) to increase M&A efficiencies

- Developed key recommendations and a playbook of best practices to support M&A processes

- Enhanced the bank’s M&A model to promote external growth and coordinate all stakeholders associated with M&As

- Support for the merger of transportation manufacturing companies

-

- Collaborated on defining IT organization, developing M&A roadmap, implementing change management approach, and managing communications

- Set up integration management office and master plan production processes

- Collaborated on defining target organizational and operational models, establishing governance, and implementing process design

- Developed integration roadmap and identified synergies in terms of, for example, value capture, contracts, cost management, etc.

- Separation of a European aerospace company’s IT organization following acquisition of a competitor’s aircraft program

-

- Conducted thorough analysis of 500+ applications, including deeply integrated applications spanning the entire aircraft development life cycle

- Delivered an objective and comprehensive analysis of available options for IT separation and the proposal of three strategic options, each of which would ensure business continuity

- Aligned decision-makers on success criteria and developed a shared vision among stakeholders

- Developed an implementation action plan and risk mitigation strategies to ensure a smooth transition

By connecting strategy to execution and bridging competing imperatives, we help clients think boldly and act pragmatically through our business consulting services.

Learn how we combine decades of consulting experience and a deep understanding of our clients’ operations with best practices, tools, and frameworks to accelerate results.

Explore our business consulting page.