Blog

Why Do Banks Need Payment Filtering & Sanction Screening Now More Than Ever?

- 1.Regulatory Compliance is Mandatory

-

- Meet stringent EU, UN, OFAC, and global regulations—non-negotiable for SEPA, SWIFT, and domestic payments

- Prevent costly fines and safeguard your bank’s reputation

- 2.KYC Alone Isn’t Enough

-

- KYC lets you know your customer; PF/SS is your last line of defense

- New sanctions arise and can affect even your best-known clients

- 3.Real-Time, No-Loss-of-Speed Assurance

-

- Meet instant payment standards (such as SEPA Instant) without compromising compliance

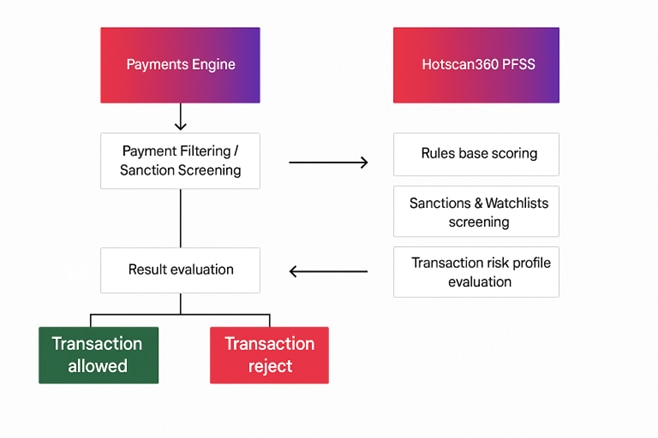

- Hotscan PF/SS processes and screens in real time by design

- 4.Reduce False Positives, Boost Performance

-

- Efficient AI/ML-driven fuzzy matching

- Flexible scoring models—a game-changer for compliance teams

- 5.Seamless Integration, Growing with Your Bank

-

- Connects to existing core banking, PSP, or custom platforms

- Scales effortlessly from thousands to millions of daily transactions

Why Choose Hotscan PF/SS?

- Real-Time Processing: Designed for today’s instant payment environments

- Performance Scalability: Adaptable as your banking operation grows

- Intelligent Screening: Human-in-the-loop AI/ML for fine tuning, rules refinement and false positive reduction

- Integrated Case Management: Keep investigations, audits, and compliance aligned

- Flexible Deployment: Choose on-premise or secure cloud

- Typical deployment takes between 4-6 months